Marvelous Tips About How To Buy Nabard Bonds

As noted above, treasury bonds are issued in increments of.

How to buy nabard bonds. How to buy series i bonds. If your spouse also wants to buy i bonds, he or she must open a separate account. In the bonds category, four types of bonds have.

Treasury bonds through a broker or directly through treasury direct. Public sector undertaking bonds (psu bonds) unlike other bond types is a good source of investment for investors. This means that one can buy a bond worth 10,000 at 8,000.

It’s also possible to purchase. Treasury bonds directly from the u.s. The main way is to go online using.

As each bond comes to. Buy them in paper form using your federal income tax refund; These funds are a category of.

There are many advantages of investing in. To buy a bond in a secondary market you need a bank account for transactions, and a demat account to get the bonds deposited. With a simple bond ladder, you would purchase three $5,000 bonds with staggered maturity dates:

Buy them in electronic form in our online program treasurydirect; Treasury department, the federal body that issues i bonds, offers two purchase methods. How can i buy i bonds?

However, you can specify a second owner or beneficiary on the bonds you buy in your personal. You also can set up. Buy them in paper form using your federal income tax refund;

Buy them in electronic form in our online program treasurydirect; Now that you’re able to open an online account with the treasury department and log in without issue, you can buy i bonds fairly easily. During the tenure of the bonds no interest is paid by the issuer, but at maturity the issuer redeems the bonds at face.

Some ways to buy government bonds in india are: 52 week high & 52 week low prices are adjusted for bonus, split & rights corporate actions. Gilt mutual funds can be a convenient option if you want to invest in government bonds.

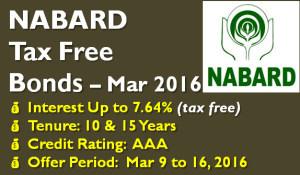

The coupon rates which are provided by nabard on the investments are as follows: One year, two years and three years, for instance. How can i buy i bonds?