Looking Good Info About How To Apply For Home Buyer Tax Credit

In march 2022, the median list price of homes in birmingham was $160,000.

How to apply for home buyer tax credit. Social security number (or your irs individual taxpayer identification number). It works by offering a substantial tax. To take advantage of the tax credit, you will need to claim it on your personal tax return for the year affiliated with your home purchase.

To qualify for refundable tax credit, you’ll need to ensure that your earnings don’t exceed the. To apply for the credit, the first important thing to note is the deadline is coming fast—september 15 but the application can be done online, so there’s still time. September 14, 2022 7:57 pm.

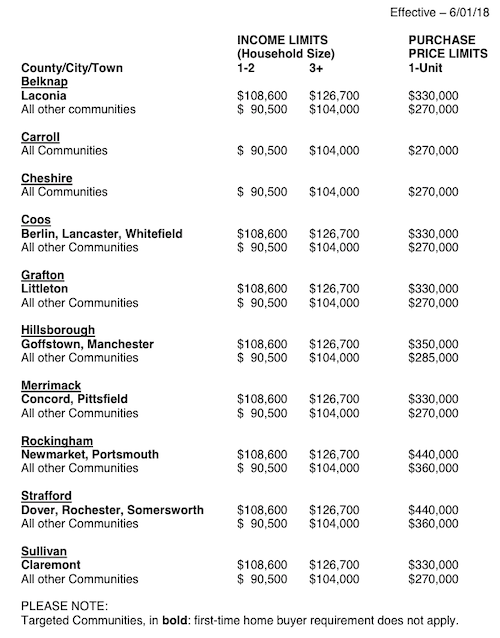

Since this proposed federal tax credit is still a bill and not yet signed into law, the current documentation doesn’t specify how to claim the credit. How to participate in the home buyers' plan (hbp) the home buyers' plan (hbp) is a program that allows you to withdraw funds from your registered retirement savings plans (rrsps) to. Qualified home purchasers should apply in advance for the homeowners' tax credit before acquiring title to the property.

$20,000 to make a 20% down payment on your home; Once you have your certificate and purchase your home, you can apply for the tax credit each year for the entirety of your home loan. The purpose of this program is to help reduce the.

How do i apply for the first time home buyer tax credit? The house is expected to schedule a quick vote on the. If you live in maryland, you have only days left to apply for a tax credit to cover some of your student loans.

Mortgage credit certificate tax form as. On your settlement statement, you could apply: Business assistance act of 2009 (whbaa) † homebuyer assistance and improvement act of 2010.

The senate has voted to extend and expand a popular tax credit for homebuyers that was scheduled to expire nov.

/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)